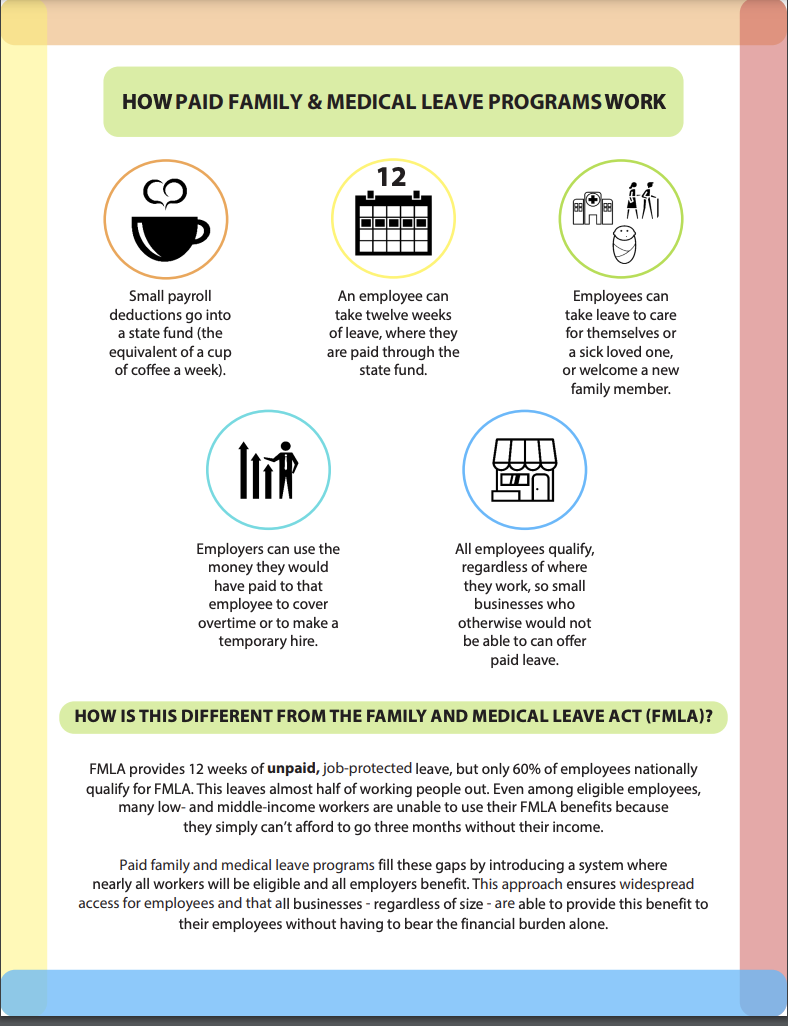

Time Matters: Paid Family and Medical Leave

The Time Matters Coalition, coordinated by the Institute, has produced a fact sheet covering the basics of what Paid Family and Medical Leave is, why it matters, and how it helps our families and thrive. The key takeaway: PFML is not a zero-sum policy. We all benefit with the implementation of such policies.

November 2024

|

|

By the Numbers: Hoosiers with Disabilities and Employment Supports

We all benefit from inclusive workplaces that invest in the talents of workers with disabilities. This factsheet lifts up statistics suggesting that we have work to do to address barriers to employment, create supportive workplaces, and ensure that Hoosiers with disabilities are aware of available resources.

October 2024

|

|

Region 9 Strategic Plan

The Institute collaborated with the Region 9 Planning Council (“R9PC”) to conduct research and strategic planning process to promote access to safe, stable, and affordable housing and community connections for all Region 9 residents. This Strategic Plan offers solutions and insights arrived at through the research process.

May 2024

|

|

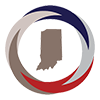

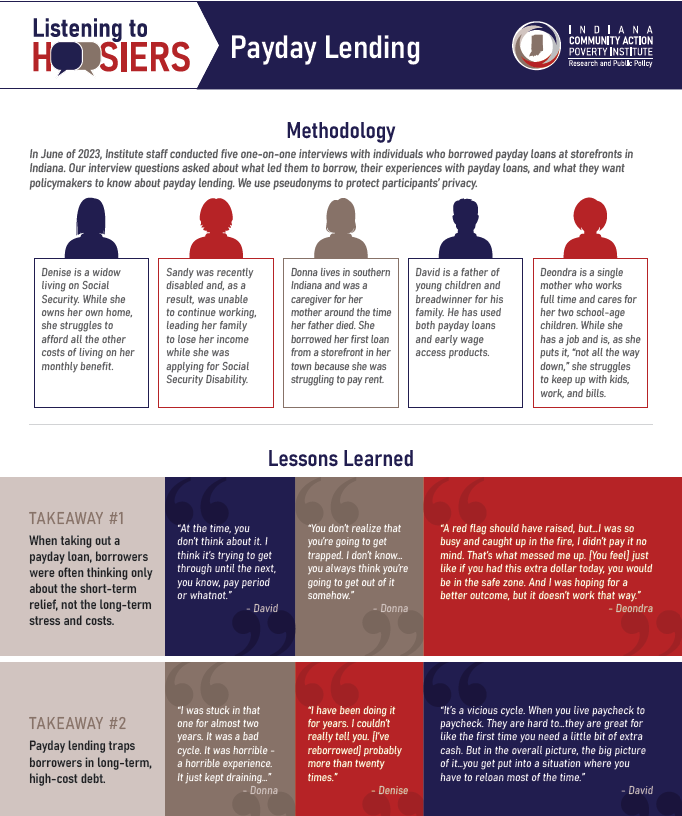

Listening to Hoosiers: Payday Lending

Payday loans are short-term, extremely high-cost loans that trap borrowers in costly debt. Our interviews with Hoosiers add to the existing understanding of who borrows payday loans and why, what they know (and don't know) when they borrow, how the cycle of borrowing and reborrowing affects them, and what supports they would like to see instead.

OCTOBER 2023

|

|

Digital Skills Unlock Access to Good Jobs

Hoosiers tell us that access to good jobs with adequate wages and benefits is a top need in Indiana. Digital skills are becoming more and more essential in the workplace, and, according to new research, jobs requiring multiple digital skills pay more. We need policymakers and community leaders to invest in opportunities to learn these skills, particularly for Hoosiers that may have lacked access to such opportunities in the past.

SEPTEMBER 2023

|

|

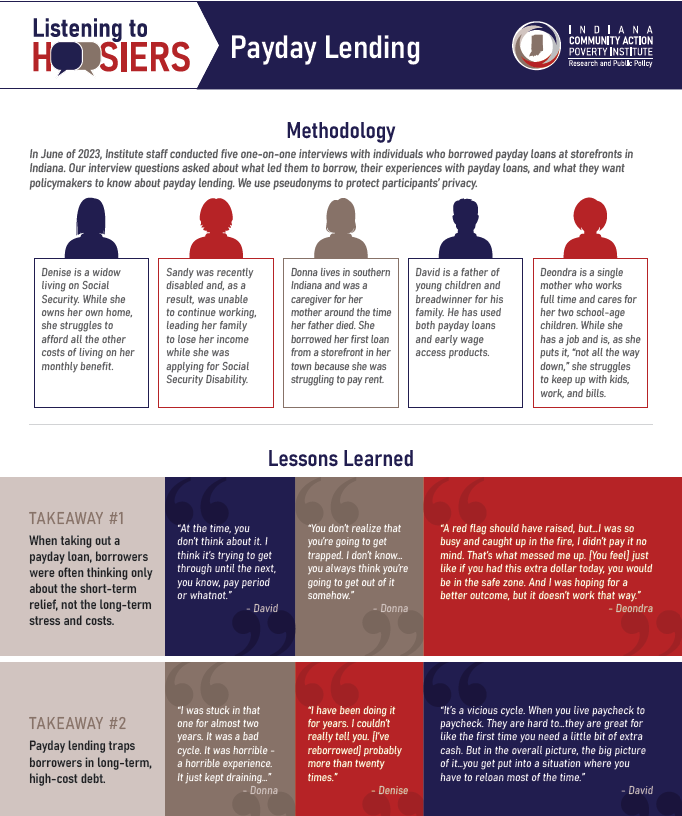

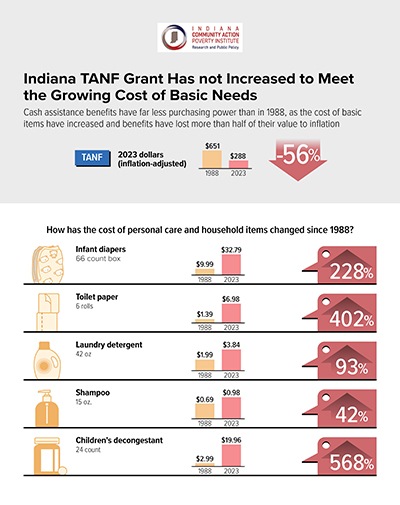

Indiana TANF Grant Has not Increased to Meet the Growing Cost of Basic Needs

Cash assistance benefits have far less purchasing power than in 1988, as the cost of basic items have increased and benefits have lost more than half of their value to inflation.

MARCH 2023

|

|

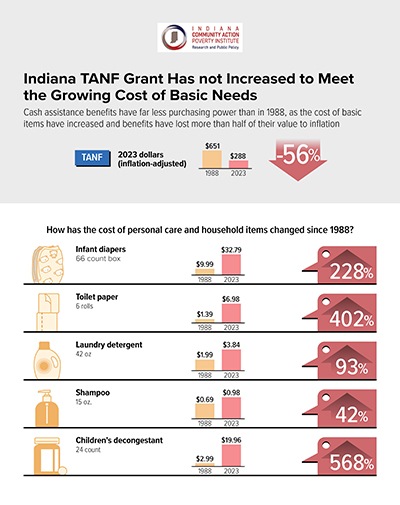

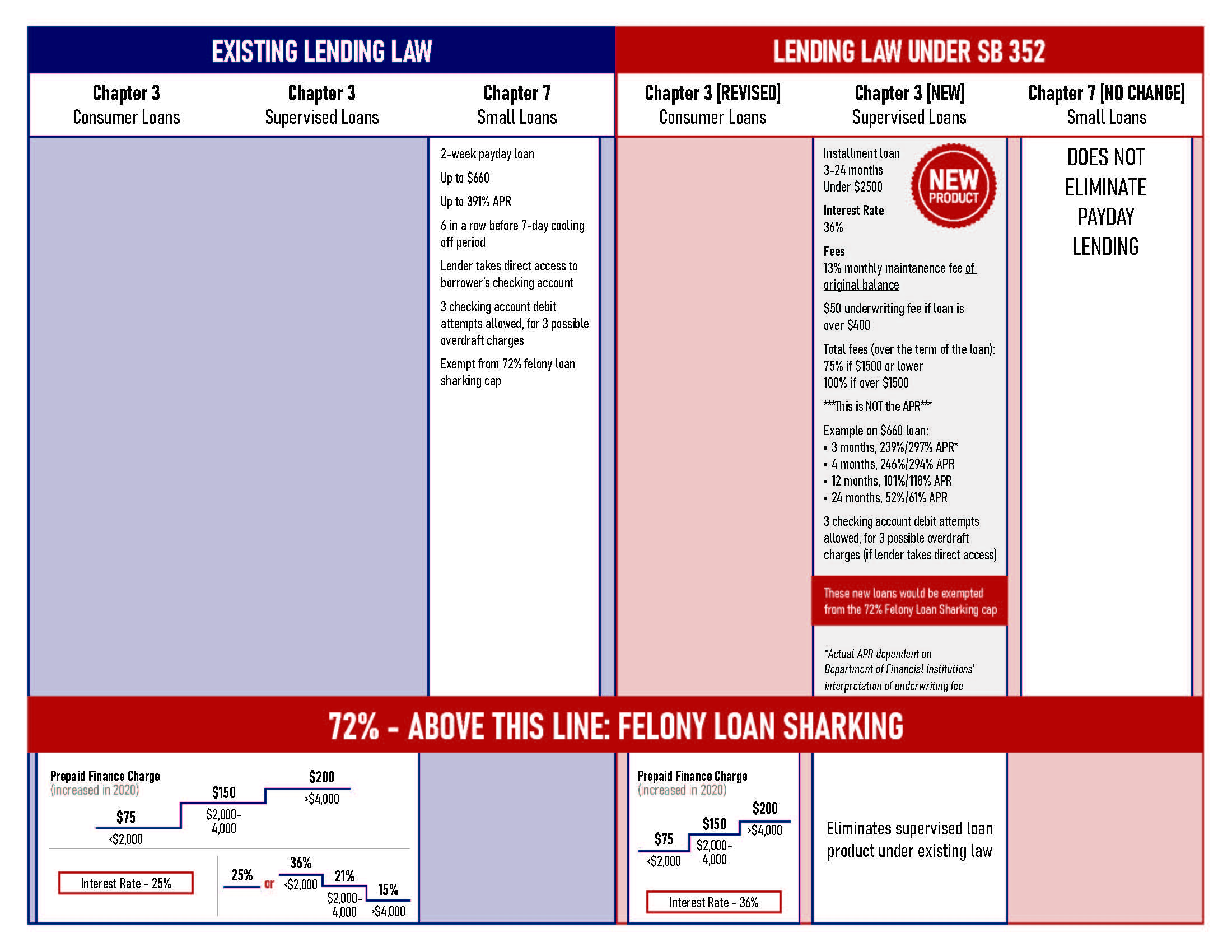

Predatory Lending

The 2022 Indiana General Assembly has proposed SB 352 Supervised consumer loans. This factsheet summarizes the Senate passed bill. This bill ultimately failed to progress in the House.

JANUARY 2022

|

|

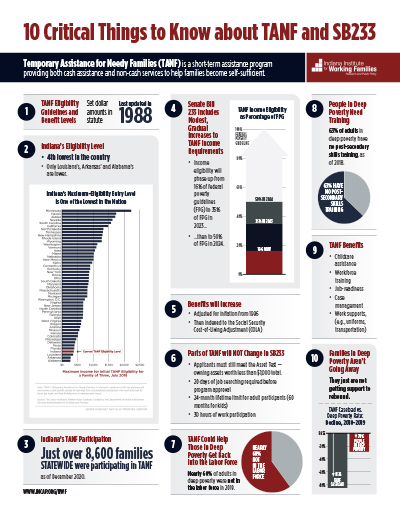

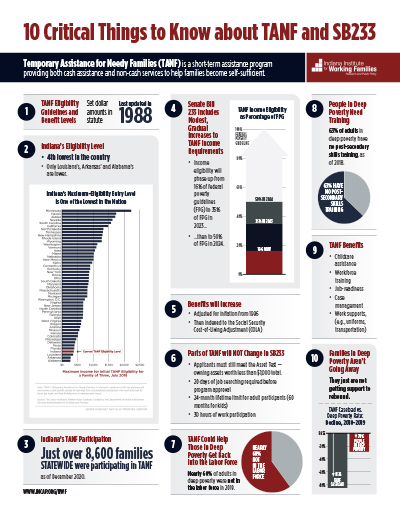

TANF: 10 Critical Things to Know

TANF (Temporary Assistance for Needy Families) needs an update if it's going to be a viable source of support for Hoosiers. Here are 10 things you need to know.

2021

|

|

Student Loan Debt in Indiana

When Hoosiers pursue their dreams of higher education, we all benefit. Unfortunately, the cost of getting an education has left far too many Hoosiers with burdensome debt that holds them back. We need to address college affordability and student loan debt to allow more Hoosiers to develop their potential and contribute to our communities without struggling to get by.

2021

|

|

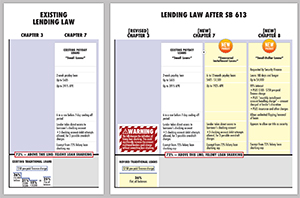

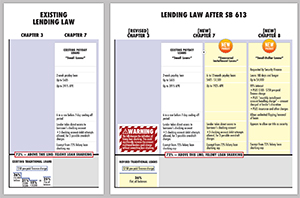

Analysis of SB 613

SB 613 would have made massive changes to Indiana's lending laws, opening the floodgates to high-cost lenders. See also this NCLC/CRL policy brief.

2019

|

|

Status of Working Families 2018

2018 | 1 page

Indiana once was a leader in the Midwest in income, poverty, employment rates, and more. Now, with declining standard of living, it faces a choice: continue the low-road policies that brought us here, or focus on policies for working families that will restore broad-based economic prosperity.

|

|

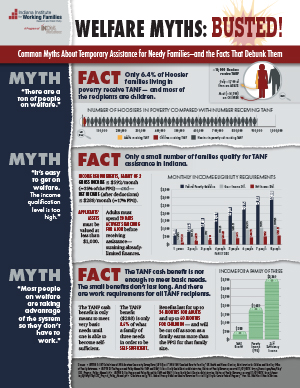

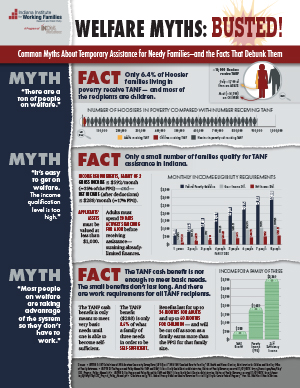

Welfare Myths: Busted!

2017 | 1 page

When it comes to programs like Temporary Assistance for Needy Families, myths abound. Learn the facts about how many people receive cash support in Indiana, what it takes to qualify for the program, and how much cash the typical program participant actually receives. Then, share with others!

|

|

Pregnancy Accommodations in the Workplace

2017 | 2 pages

More and more women are working throughout pregnancy, but pregnant women still face high levels of workplace discrimination. Accommodating reasonable requests - to sit, to carry a water bottle - can make it possible for women to work safely and productively throughout pregnancy.

|

|

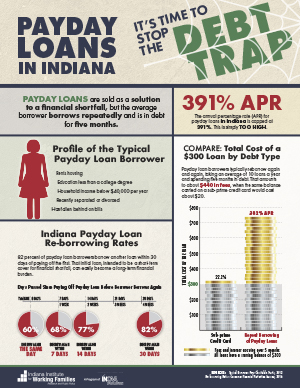

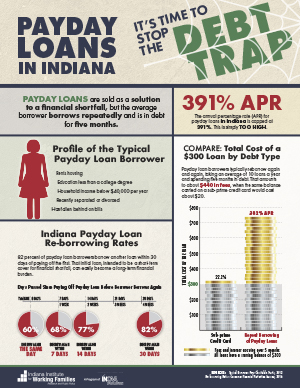

It's Time to Stop the Debt Trap

2017 | 2 pages

Payday loans in Indiana are costly and trap low-income borrowers in a cycle of debt. The typical borrower takes 9 or 10 loans a year, paying over $400 to re-borrow a $300 loan. This has ripple effects on local economies.

Polling shows strong support for a 36% rate cap on payday loans.Many organizations support a rate cap of 36%.

SB 613 would open the floodgates to predatory lending.

|

|

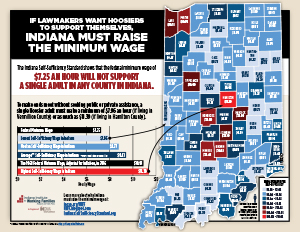

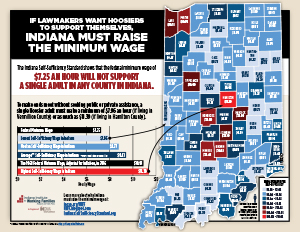

Indiana Must Raise the Minimum Wage

2016 | 1 page

In Indiana, $7.25 an hour will not provide enough income for even a single adult to support themselves in any county. If lawmakers want Hoosiers to be self-sufficient, they must raise wages.

|

|

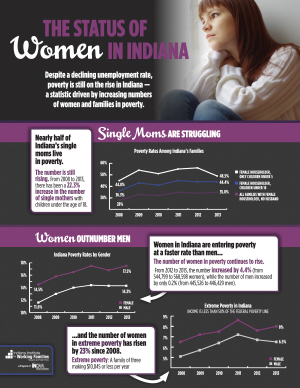

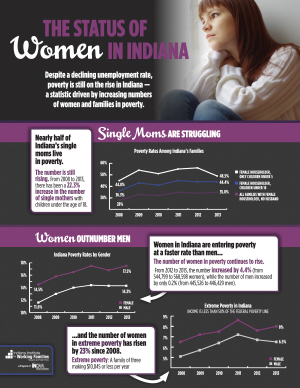

The Status of Women in Indiana

2015 | 2 pages

Despite declining unemployment, women - and particularly single mothers - are still struggling.

|

|