Strong Personal & Public Safety Nets

While employment is an important pathway to financial well-being, work alone does not always provide enough income to meet basic needs. There are also times Hoosiers cannot work due to lack of opportunities, caregiving obligations, health needs, or other barriers. Assets such as home equity and emergency savings can provide a buffer against dips in income, while a strong public safety net must be available to ensure that Hoosiers that lack assets or sufficient income can still afford the basics. Our safety net work encompasses access to:

- Asset Development Opportunities

- Supplemental Nutrition Assistance Program (SNAP)

- Temporary Assistance for Needy Families (TANF)

- Tax Credits

- Work Sharing and Unemployment Benefits

We also work on program effectiveness through strategies like:

- Mitigating the Cliff Effect

Featured Publications

|

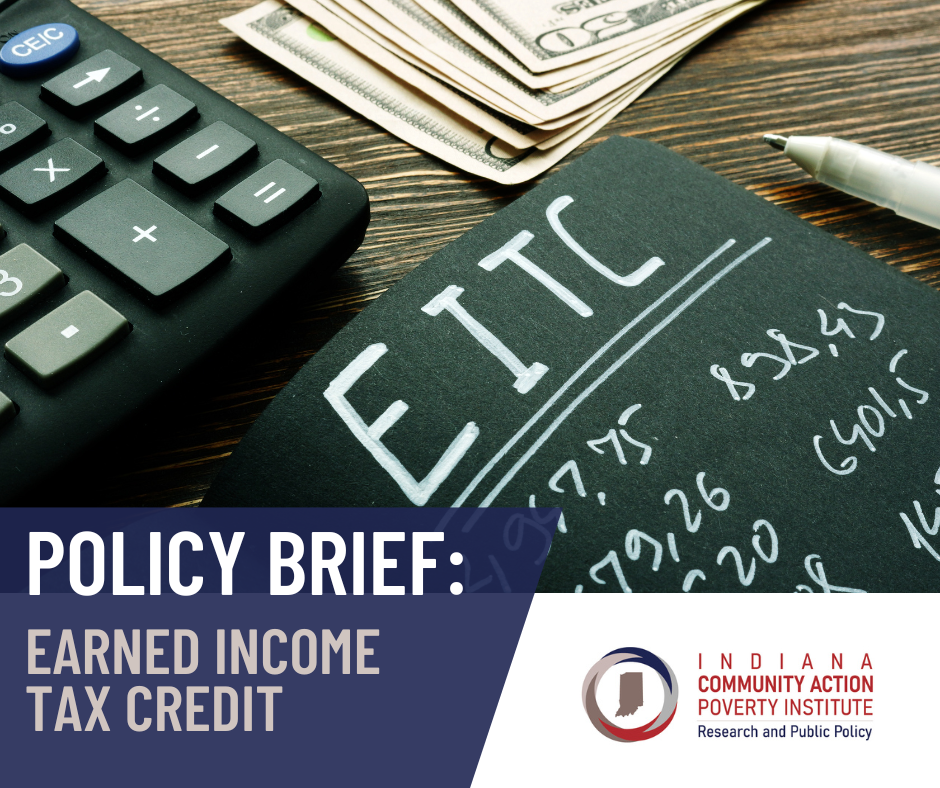

Earned Income Tax Credit

The federal and state EITCs are available to most low- to moderate-income working families and individuals, and function as a wage subsidy by boosting earnings as workers increase their hours, which encourages work. These credits life millions out of poverty, but have room for improvement. Federal and state lawmakers should enact changes to both credits that (1) ensure parity between the treatment of childless workers and those with children, (2) eliminate "marriage penalties", and (3) drive higher participation. | POLICY BRIEF

|

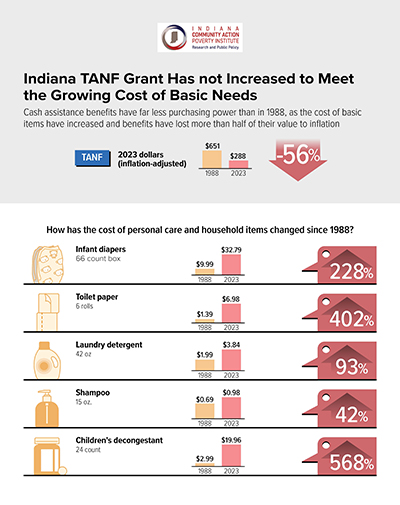

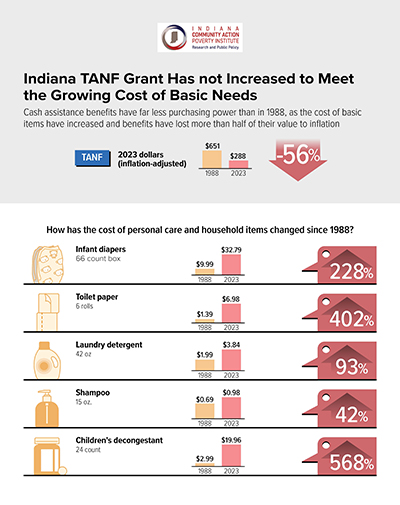

Indiana's TANF Grant & the Growing Cost of Basic Needs

Cash assistance benefits have far less purchasing power than in 1988, as the cost of basic items have increased and benefits have lost more than half of their value to inflation. | FACT SHEET

|

|

Other Publications

Take Action!

|