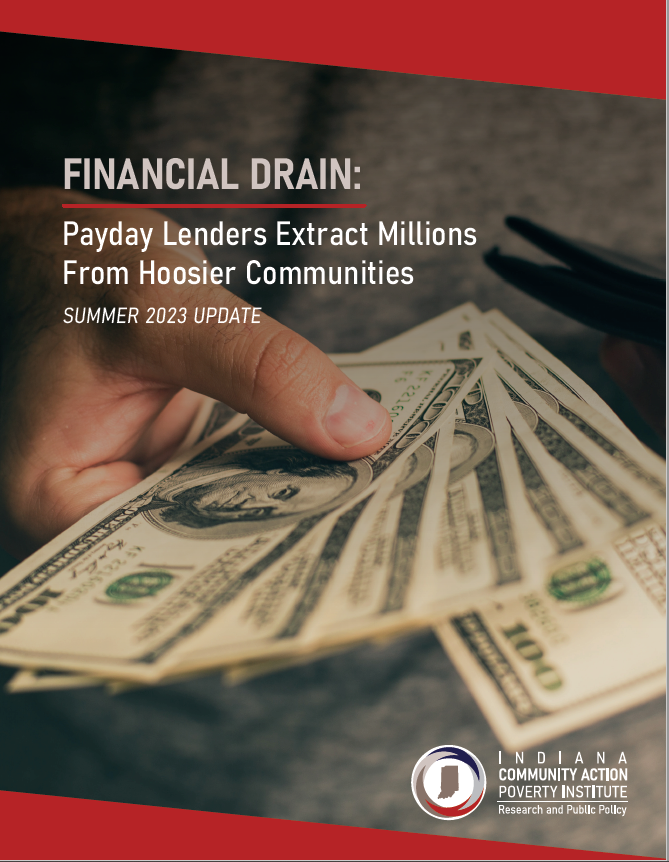

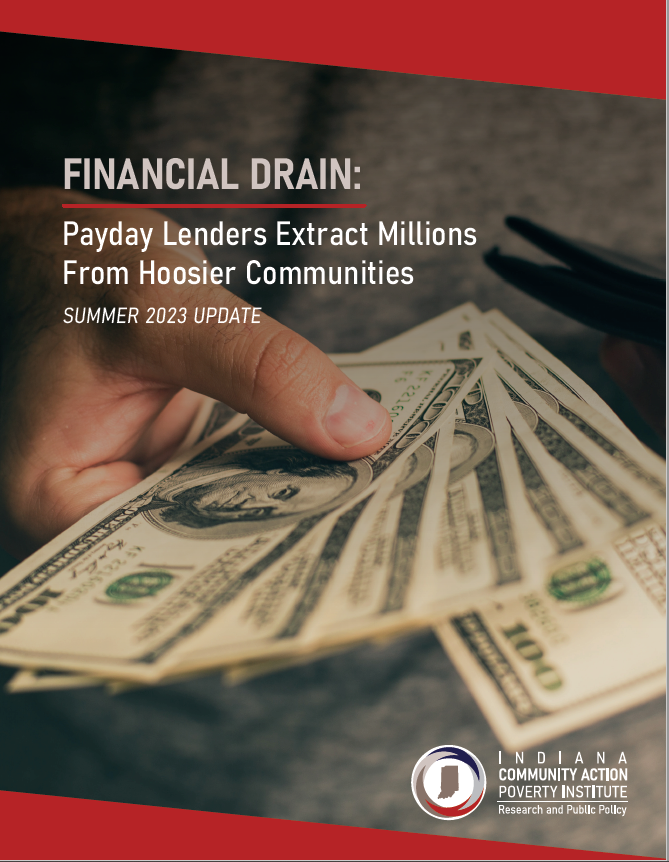

Payday Lending: A Drain on Hoosier Families and Communities

|

In 2002, the Indiana General Assembly granted payday lenders an exemption to Indiana's interest rate cap of 36 percent and criminal loansharking limit of 72% APR. In just two decades, payday lenders have established a significant footprint across our state. In 2002, the Indiana General Assembly granted payday lenders an exemption to Indiana's interest rate cap of 36 percent and criminal loansharking limit of 72% APR. In just two decades, payday lenders have established a significant footprint across our state.

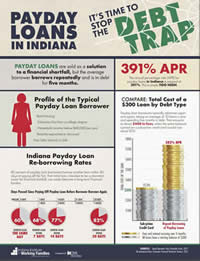

This update on our 2019 report shows that payday lenders drain over $29 million in finance charges from Hoosier borrowers annually on loans that average $386. Effective January 2023, the maximum payday loan increased from $605 to $715, and lenders can charge rates as high as 391% Annual Percentage Rate (APR). As the report shows, Indiana saw a precipitous drop in loan volume during 2020, likely due to robust federal support in response to the COVID-19 pandemic. Since the expiration of important federal supports such as the expanded Child Tax Credit, additional unemployment insurance, and rental assistance, payday loan volumes are trending toward their pre-pandemic levels.

|

2019 Financial Drain Report

Our 2019 report, Financial Drain: Payday Lenders Extract Millions from Hoosier Communities, documents the scope and impact of these lenders on families and communities, finding:

- Payday lenders have drained over $300 million in finance charges from Hoosier families and communities in the past five years.

- There are 262 payday loan storefronts across Indiana, and out-of-state companies operate 86% of them.

- Payday storefronts are disproportionately located in low-income communities and communities of color.

- The typical payday loan borrower has a median income of just over $19,000 per year and re-borrows eight to ten times, paying more in fees than the amount originally borrowed.

- Many borrowers experience a cascade of negative consequences, include overdrafts, defaults, involuntary bank account closure, bankruptcy, and more.

Quick Facts About Payday Lending Quick Facts About Payday Lending

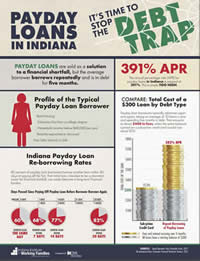

Payday loans trap borrowers in a cycle of high-cost debt. Learn the facts:

- The typical borrower is a renter earning less than $40,000 per year.

- 60% of payday loans are re-borrowed the same day an old loan is repaid.

- Compared to carry a balance on a credit card, a payday loan can cost 15-20 times as much.

- Payday lending can drive borrowers into bankruptcy.

- Indiana has one of the highest bankruptcy rates in the country.

- Payday lenders drain tens of millions in fees each year from Indiana's economy.

Polling Shows Hoosiers Support Reform Polling Shows Hoosiers Support Reform

Bellwether Research & Consulting asked 600 Hoosiers about payday lending:

- Nearly 90% of Hoosier voters support a 36% APR cap, even after hearing pro-industry arguments against the proposal.

- Eight-seven percent say payday loans are a "financial burden" and 84% think they are "harmful."

- Three out of four voters would oppose a new payday loan store opening in their neighborhood.

- More than one third of polling respondents had taken out or knew someone who had taken out a payday loan.; these respondents expressed similarly high levels of support for reform.

- A large & diverse coalition also supports payday lending reform in Indiana.

Ready to Help Stop the Debt Trap?

Other Resources Related to Payday and Subprime Lending

|

Quick Facts About Payday Lending

Quick Facts About Payday Lending Polling Shows Hoosiers Support Reform

Polling Shows Hoosiers Support Reform